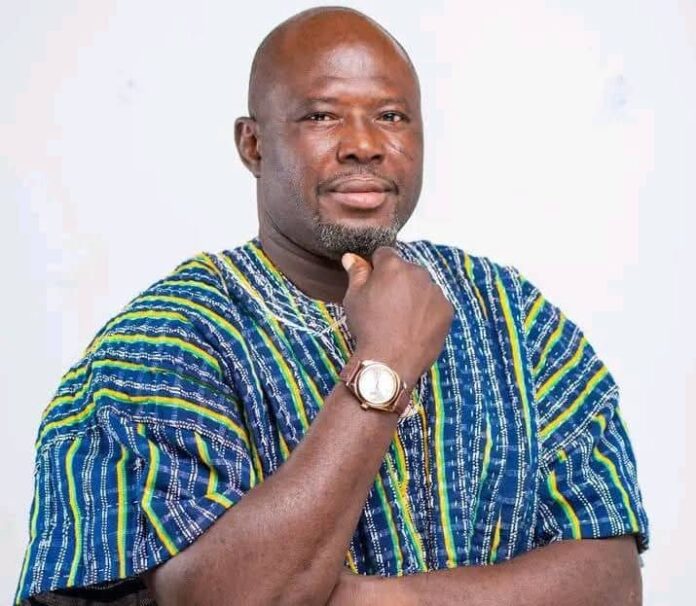

The Upper East Regional Research and Electoral Officer of the New Patriotic Party (NPP) Daniel Ziba says the recent strong showing of the local currency cannot be credited to the Mahama administration.

According to him, the cedi’s appreciation against major international currencies in recent times is as a result of a windfall occasioned by the ongoing trade war between the world’s two biggest economies – the USA and China – and is not linked to any policy of the administration.

“When you look at the dollar, yes, it has come down. But what policy initiative has the government undertaken that actually pulled it down? There hasn’t been any policy. It’s just a windfall,” he stated.

“Every country, when you check all their currencies, they are all appreciating well against the dollar. So, it’s not a policy specific in Ghana that has caused it.”

The Ghana cedi has, since April, gained significant strength against major world’s currencies, starting the year at 15.83 to a dollar and now trading around 12.30 to a dollar.

US-based media outlet Bloomberg, on May 7, 2025, adjudged it the world’s best performing currency, stating that it had appreciated almost 16 percent against the US dollar at the time.

It had further surged by 16.7 percent year-to-date as at May 13, according to the Minister of Finance Dr. Cassiel Ato Forson and has continued to gain ground in the forex market.

The Minister attributed the local currency’s performance to, “a robust policy framework, underpinned by synchronized monetary and fiscal measures, as well as a favourable global context,” JoyNews reported.

But Ziba, speaking in an interview on Breakfast Today on Dreamz FM, disputed this assertion, arguing that the cedi’s performance is not driven by any government policy.

He said despite the cedi’s strong showing, it has not reflected in the cost of goods and services because of the uncertainty of its sustainability due to what he claimed is the lack of policy backing.

“These people are saying that they cannot give a specific indicator that prompts the cedi to be doing well against the dollar. So, assuming that they reduce prices today and tomorrow they are going back to purchase those items in dollars and the dollar rises (against the cedi). What do they do? Some of them will close down their businesses.”